A no claims discount NCD or no claims bonus NCB that a policyholder has accumulated over time can help lower the cost of car insurance. No Claim Bonus NCB is a reward given by an insurer to a policyholder for making no claims during the policy term.

As per the current rules in India the range of NCB is from 20 on the Own Damage Premium and increases to 50 which is the maximum amount of bonus possible.

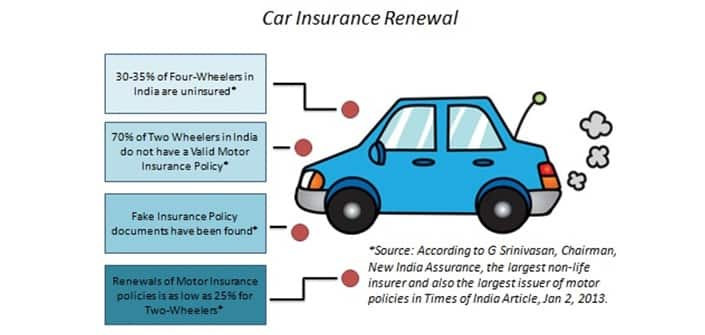

Car insurance ncb rules. As per the Motor Vehicles Act it is mandatory for vehicle owners to at least have a third-party liability cover in case anyone is seen driving a vehicle without a valid motor insurance plan heshe be penalised. The No Claim Bonus NCB is given to the policy owner and not to the insured vehicle. The amount of money its worth varies for each insurer but the more consecutive years you go without making a claim the less of a risk you are to.

No Claim Bonus NCB is the discount in your car insurance premium enjoyed by you for not having made a claim in the previous years. Enjoy our exclusive offers from variety of car dealerships and approved distributors that are tailored to your needs and convenience ensuring a pleasant experience in getting the vehicle of your choice. No Claims Bonus.

This discount can be accumulated on a yearly basis starting from 20 at first claim free renewal 25 in the second 35 in the third 45 in the fourth and 50in the fifth and continued for subsequent claim free years. Comprehensive Motor Vehicle Insurance Insurance is a contract between you and the insurance company that protects you against losses you may suffer. This touches 50 percent at the end of 5 years if there are no claims from your side.

A valid Vehicle Insurance Policy in the name of the customer. In the first claim-free year you get 20 NCB. NCB discount ranges from 20 to 50 on the own damage premium.

Simply put it encourages safer driving behaviour. If the renewal premium is INR 14000 you would have to pay only INR 11200. The NCBs offered by the insurance companies start from 20 percent and then go on to 50 percent on a yearly basis.

However note that NCB is not transferred to one person from another unless the owner of the car passes away and the car is passed on to the heir. The No Claims Discount NCD or No Claims Bonus NCB is a common feature in car insurance. The standalone third party car insurance policy is a basic but legally mandatory car insurance policy.

A no-claims bonus of five years or more. No Claim Bonus NCB in Car Insurance. Residents should bring a letter from Traffic Department stating the.

So it is helpful to inquire about it at the time of buying or renewing your car insurance. However you can use the retained NCB certificate is issued when buying a new policy for your new car. An original valid Periodic Vehicle Inspection Certificate linked with Traffic Department.

A no-claims bonus NCB sometimes referred to as a no-claims discount is the number of years that you havent claimed on your car insurance policy. It protects you from the legal and financial liabilities that arise from damages caused to a third-party person or property by your insured car. Save on car insurance premium.

However this policy does not cover any damages to the insured car. The amount saved is proportionate to the consecutive number of years that a person has held a policy in their name without making a claim. You can build up this bonus for a maximum of 15 years.

In a bid to offer a great car insurance deal National General Insurance provides a No Claim Bonus NCB to its policyholders for making no claim in a policy year. If you dont make any claim during the first year you will get an NCB of 20 percent. Make sure that the insurance company linked the vehicle data to the Najm system.

If there are still no claims on your policy you keep getting a discount. If no claim is made in the first policy year you earn an NCB of 20. No Claim Bonus NCB is a discount offered on Own Damage OD premium for not claiming on your car insurance during the policy period.

The No Claims Bonus is a reward from insurance providers to safe drivers for not making any claims. Its a discount that car insurance customers receive if they havent made a claim for a set period of time starting from 1 year. NCB or No Claim Bonus is a benefit that accrues for the insured in the event of no claims made during the period of the previous vehicle insurance policy.

NCB transfer rules suggest that the benefit cannot be transferred to a new owner of the vehicle in case of a sale as the NCB is. The benefit everyone loves. Well be using these terms interchangeably throughout this guide.

Just remember that there should not be a gap of more than 90 days between the expiry date of your insurance policy and renewal. No Claim Bonus can be accumulated as a discount on the premiums over years. Get your insurance with your NCB auto loan payment and in exchange for paying your premium Guardian General Insurance Jamaica Limited will pay your losses as outlined in your policy.

In the second claim-free year it will be 25. In the third claim-free year it will be 35 then 45 and then 50 the maximum discount offered. Connected to you and not your car.

In the process of selling a used car while the previous owner signs over the registration and insurance details there is an important exception to the car insurance transfer process. For more information please call 920000891 or go to our sales representative at the dealers showroom. Therefore the NCB cannot be passed on to another name.

Suppose you buy car insurance plan and pay a premium of INR 15000. Use NCB of old car policy to save on new car premium. A no claims discount or no claims bonus NCB is a discount that can be applied to an insurance policy based on the number of consecutive years the policyholder has gone without making any claims.

NCB is connected to you as an individual and not your car. This means no matter which car you have- as long as you have been renewing your car policies before its expiry date you can continue to benefit from a NO Claim Bonus for your car insurance. In order to avail the car insurance plan to the fullest every policyholder should be aware of NCB benefit during the plan purchase.

A no claim discount NCD sometimes referred to as a no claim bonus is a discount your insurer can apply to the price of your car insurance policy for every year that you havent made a claim. Again in the next year if no claims are made the bonus would increase to 25. Brand new drivers setting up a policy for the first time.

Your NCB can reduce your OD premium by up to 50 The maximum NCB discount offered by insurance providers stands at 50 which you earn by the end of five years of making no claims. The NCB is lost in the subsequent period of a car insurance policy if the insured lodges a. This means that for each claim-free year the No Claim Bonus can be earned starting from 20 and go upto a maximum of 50 over a span of 5 years.

The No Claims Bonus NCB.

10 Secret Things You Didn T Know About Car Insurance Comparepolicy

Car Insurance Policy Online At Killer Prices With Easy Claims

Here Are 4 Future Trends Of Motor Insurance In India Online Insurance Insurance Future Trends

Jeanson Renewal Pdf Liability Insurance Insurance

No Claim Discount Ncd The Complete Guide For Malaysia Car Owners

10 Must Knows Of Car Insurance Renewals

What Is No Claim Bonus Ncb In Car Insurance Explained

No Claims Bonus How It Gives You A Discount Admiral

What Is No Claim Bonus In Car Insurance Abc Of Money

Top 12 Real World Car Insurance Queries Answered Faqs

Top 5 Things To Know About No Claim Bonus Ncb

Buying A Car After August 1 Know The Own Damage Policy Changes In Store

Buy Two Wheeler Insurance In 4 Easy Steps It Provides Online 2 Wheeler Insurance With Hassle Free 24 7 Claim Sett How To Protect Yourself Insurance Supportive

Car Insurance Calculator Calculate Car Insurance Premium Policyx Com

What Is No Claim Bonus Ncb In Car Insurance Explained

What Is No Claim Bonus Ncb In Car Insurance Explained

Ncb No Claim Bonus In Car Insurance 5 Must Knows Bajaj Allianz

Car Insurance Rate Car Insurance Team Bhp

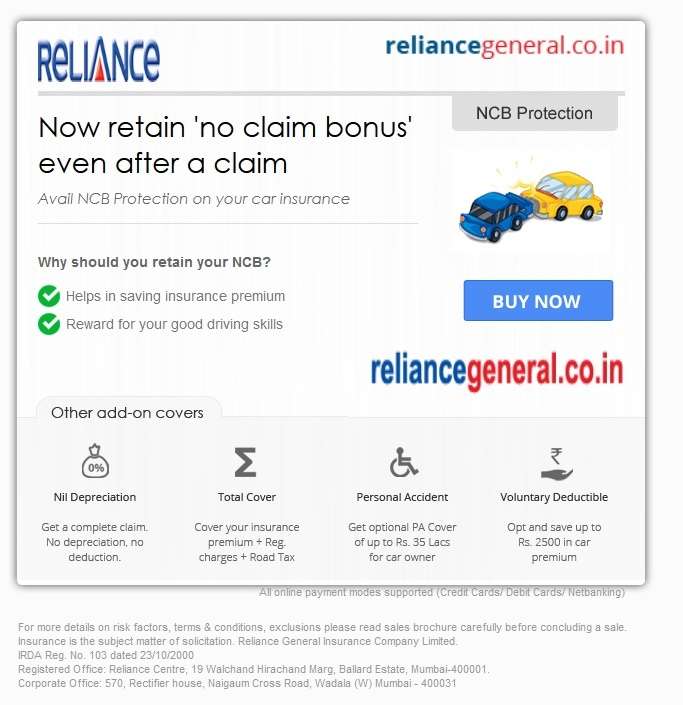

No Claim Bonus Ncb With Your Motor Insurance Policy Reliance General Insurance