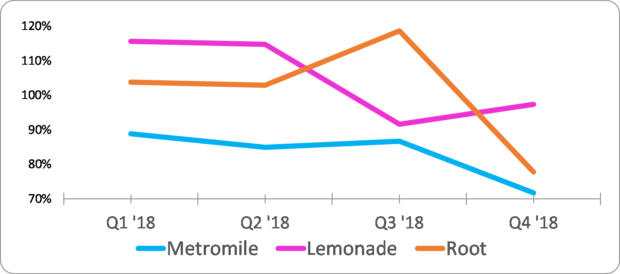

Lemonades loss ratios still look way to high compare to other insurance companies. The net loss ratio is a profitability metric used in the insurance industry and its a measure of incurred losses divided by.

Opening Day Balance Sheet Template Balance Sheet Template Balance Sheet Personal Financial Statement

The reinsurer would pay 525 and Lemonade 175.

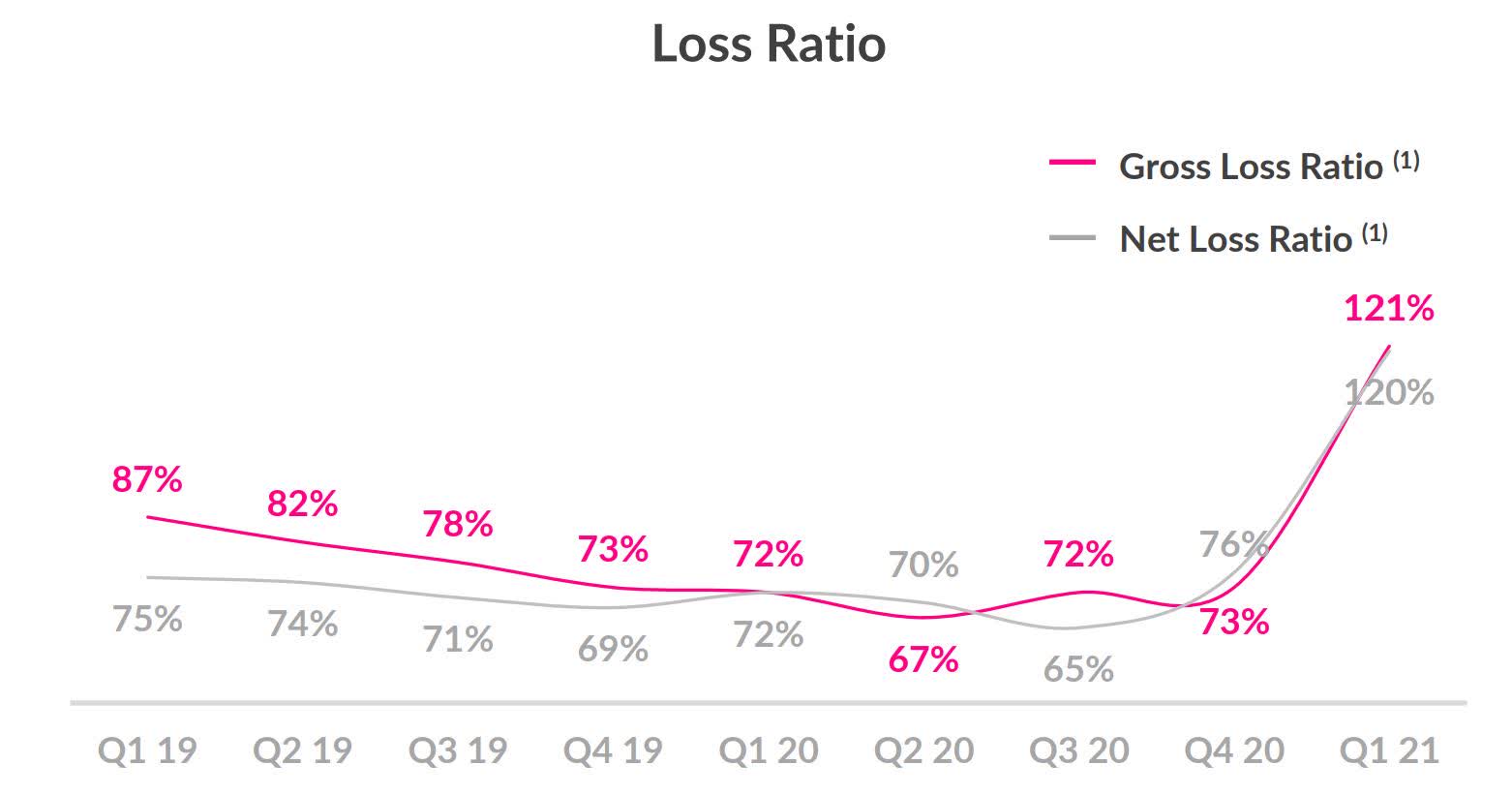

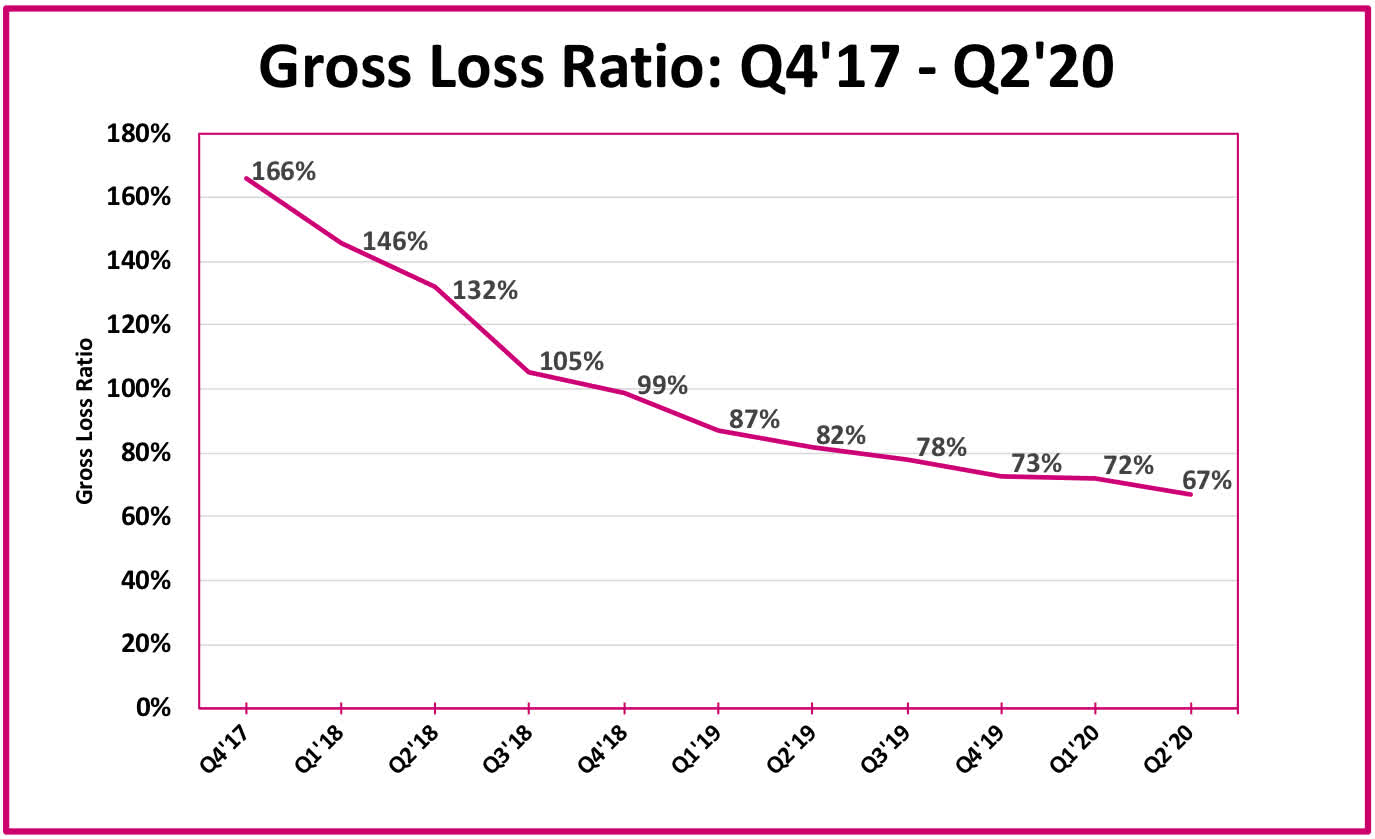

Lemonade insurance loss ratio. Loss ratio is calculated by dividing the total claims processed by total collected premiums. Lemonade recovered beautifully in Q2 bringing the numbers right back down. The insurtechs net loss ratio forecast for 2020 is set at 72 which indicates a 100 combined ratio when considered alongside 2-3 points of expense and the 25-6 points of ceding commission.

Compared to Assurant Lemonade really does not seem to have a chance of making a profit. Our Q3 21 gross loss ratio was 77 up from 72 a year ago notwithstanding the fact that our newer products are demonstrating improving loss ratios. So based on an expected 70 loss ratio for every 100 in premium we expect 70 in losses.

Loss ratio of Lemonade in the US. For Q4 2020 Lemonade reported a gross loss ratio of 73 which is exactly the same as Q4 2019. The remaining 70 of premiums are ceded to reinsurers who.

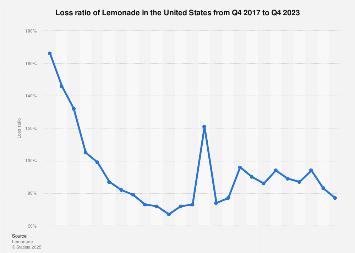

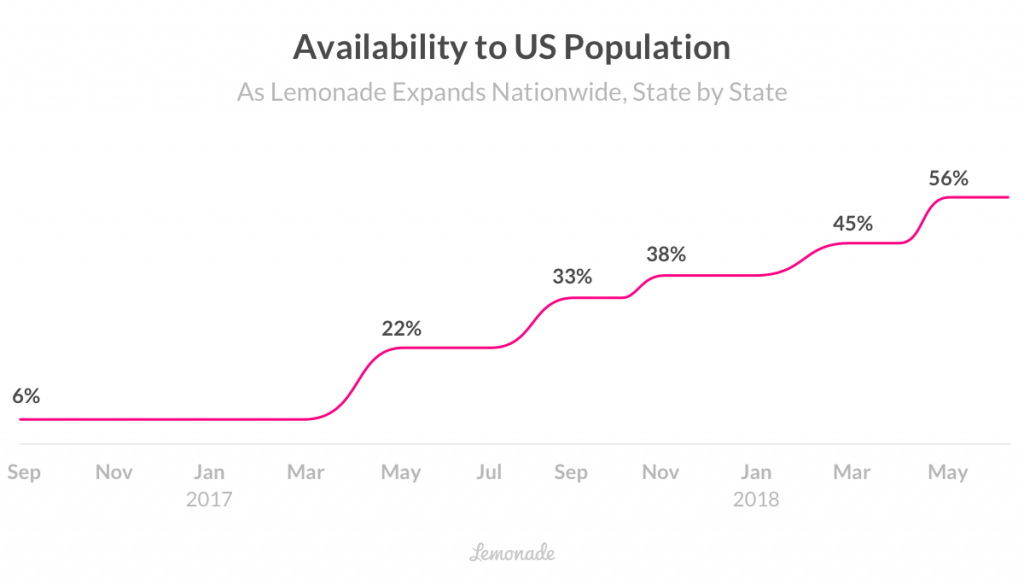

So based on an expected 70 loss ratio for every 100 in premium we expect 70 in losses. The loss ratio net losses and loss adjustment expenses as a percentage of net earned premium was 211 according to Insurance Times calculations and the combined operating ratio COR an eye-watering 3832. In a deleted tweet Lemonade stated its use of predictive data lowers its loss ratioIn Q1 2017 our loss ratio was 368 friggin terrible and in Q1 2021 it stood at 71 In other words in 2017 Lemonade was not making as much money off its customers as it was paying out claims at a far greater rate than the amount of premiums paid by customers.

Lemonade collects a fixed fee currently 30 of premiums that is used to cover expenses and their proportional share of customer claims with the surplus being used to generate a small profit. This means the company is paying out 38 for every 1 it is bringing in calling into question how it was able to pay any giveback at all. The reinsurer would pay 525 and Lemonade 175.

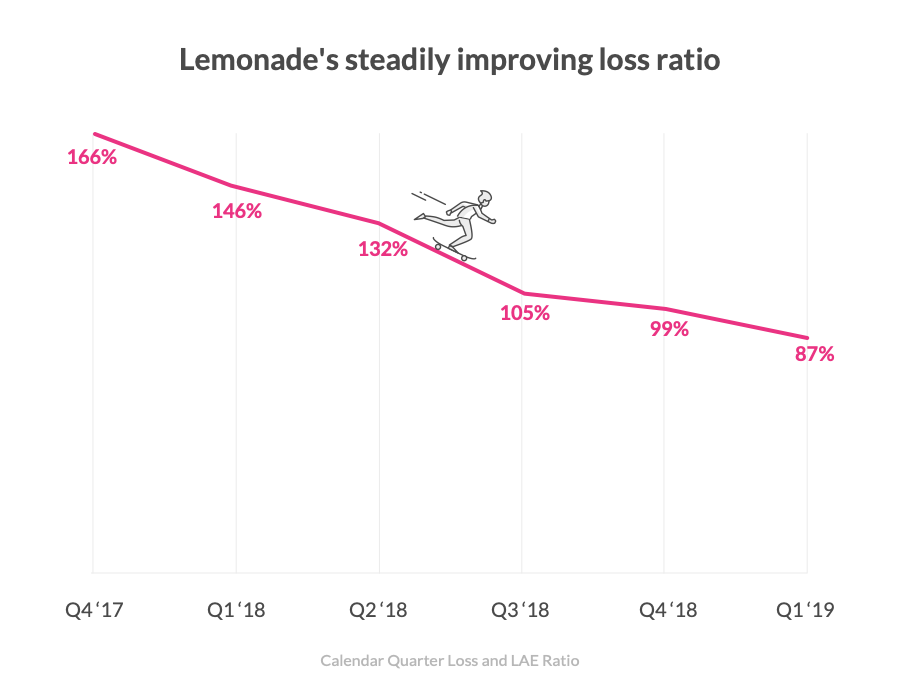

Last year its net loss ratio. This arrangement leaves Lemonade with approximately 27 for all other expenses and profit. At the end of 2017 its loss ratiothe amount it pays in claims divided by the premiums it collectswas an unsustainable 166 compared to 65 to 70 for large insurers.

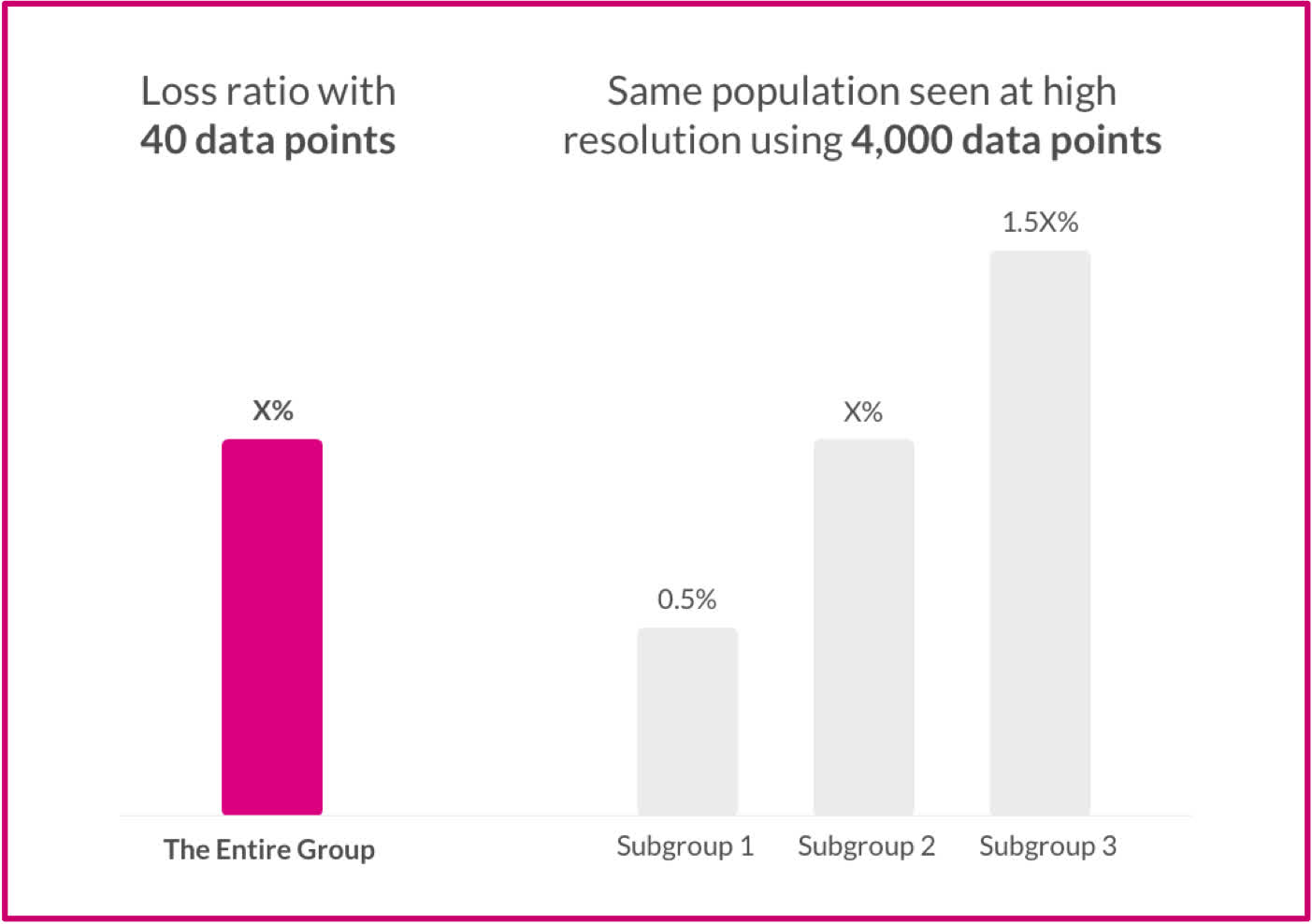

The long-term viability of the business model profitability is dependent on this metrics strength. In the first quarter Lemonade reported a net loss ratio of 120. In the long term and since this needs to work for our reinsurance partners as well we need to ensure we select the right customers and charge them the right amount.

The New York-based InsurTech posted a 108 net loss per share in the quarter weaker than the 057 loss per share from Q3 2020 but above the 116 loss per. In the medium term customers are well protected and Lemonade has a fixed net loss ratio after reinsurance. Ideally we would want both the loss ratios to be lower than 5625 for Lemonade to start being profitable.

Property Casualty Insurance Industry for the period 2010-2019 it has been varying between 67-795. During the fourth quarter of 2020 Lemonades registered a loss ratio of 73 percent the same value as in. Taking 75 of the risk for every premium dollar Lemonade writes reinsurers are bearing the bulk of the loss ratio outcome good or bad JMP Securities notes.

But looking at the NAICs industry-wide net loss ratios for US. The ratio of dollars paid out to dollars earned is called a Loss Ratio and at 368 it was called a Friggin Terrible Loss Ratio. For every dollar we earned in Q1 2017 we paid out 368 in claims.

Lemonade also stated. Since then its dropped steadily and steeply and our 2019 third quarter Loss Ratio was 78 and trending downwards. I have not been able to compare Lemonades loss ratios to other insurance companies.

Lemonades Loss Ratio Is Worrisome. At least there is some good news in this regard. Lemonade net loss ratio jumps to 81 in Q3.

Lemonade has revealed a 16 point increase in its net loss ratio to 81 percent in the third quarter with the New York-listed insurtech pointing to the higher loss ratios in its newer business of home and pet insurance. However Lemonade was still able to report a gross loss ratio of 71 for all of 2020 which is still a 10 year-over-year YoY decrease from 2019. An insurance companys loss ratio is a determinant of a businesss efficiency.

This arrangement leaves Lemonade with approximately 27 for all other expenses and profit. Those improvements were predicated on a falling loss ratio. From paying out 368 in claims for every dollar it earned back in 2017 Lemonade has improved the figure to 078 it.

5 Our business mix has evolved considerably since a year ago with renters comprising 53 of the book relative to 70 a year ago. Personal lines InsurTech Lemonade reported a net loss that more than doubled in the third quarter to 66mn from 31mn last year while the companys net loss ratio jumped 16pts to 81.

Nearly There Why Lemonade S Steadily Improving Loss Ratio Is Important

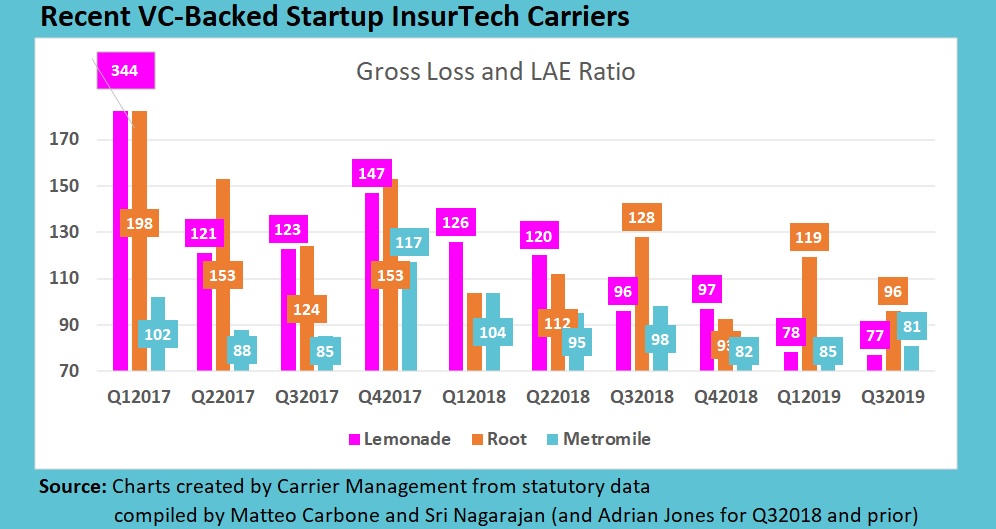

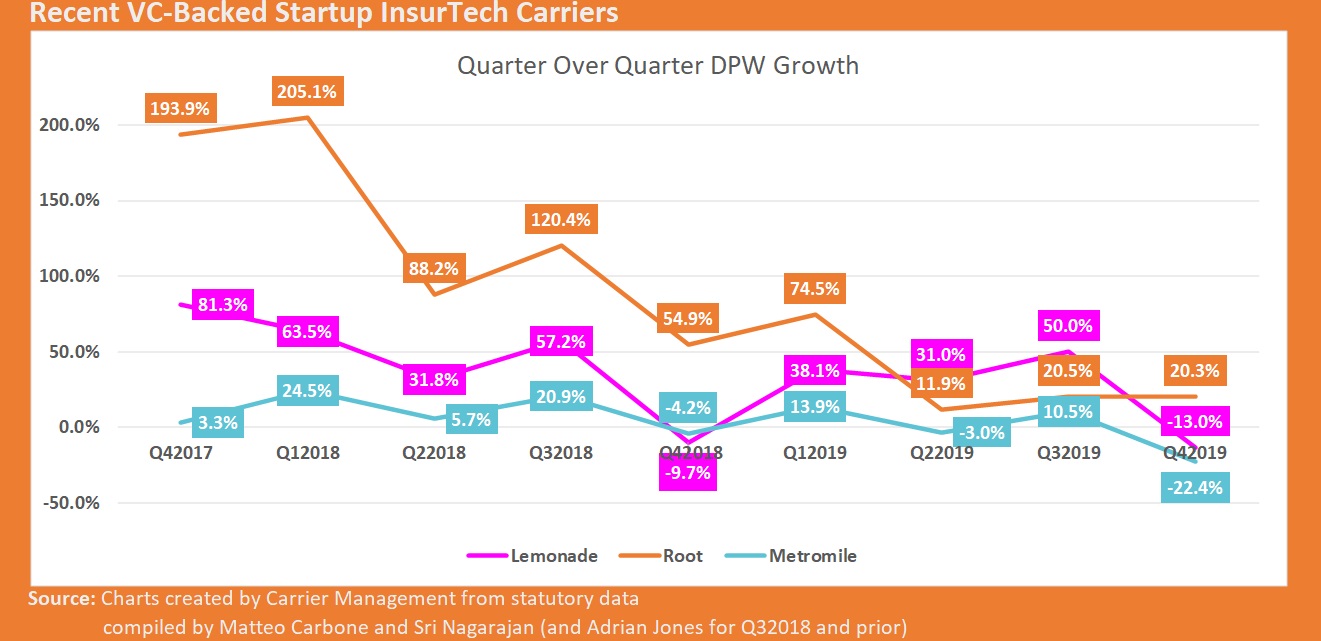

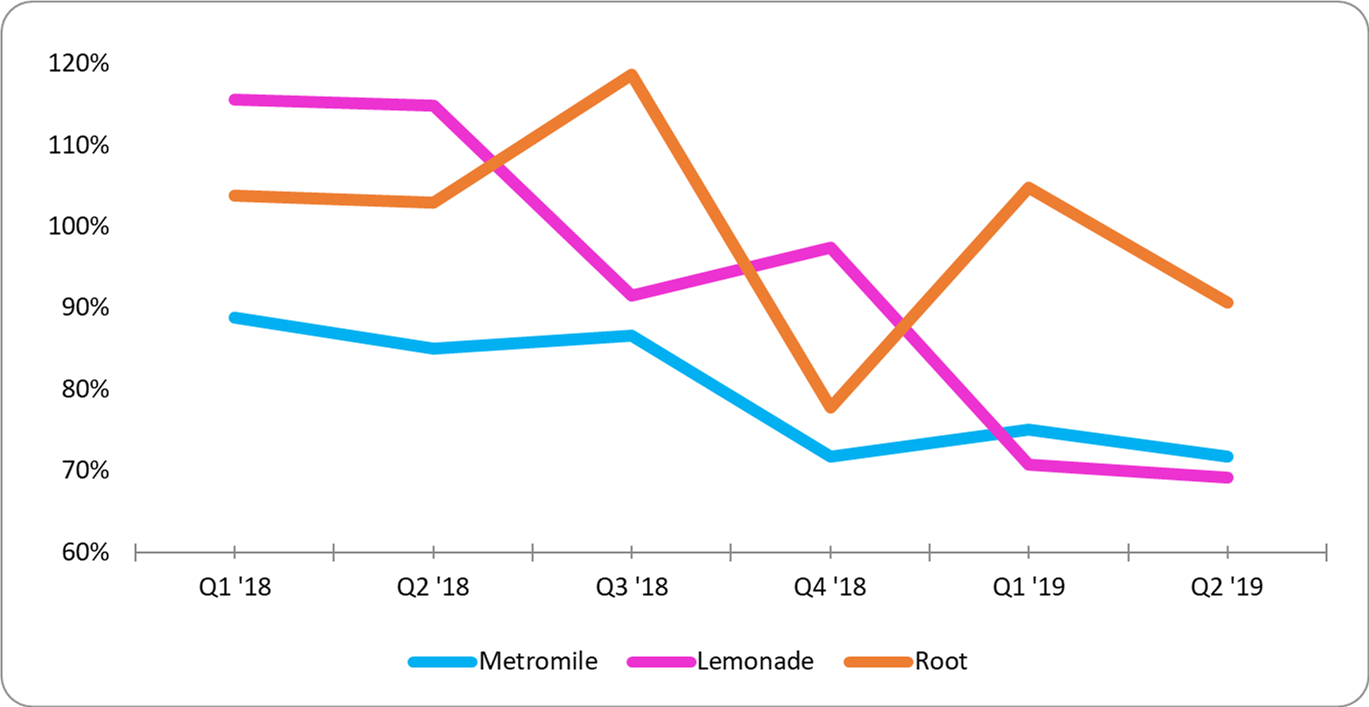

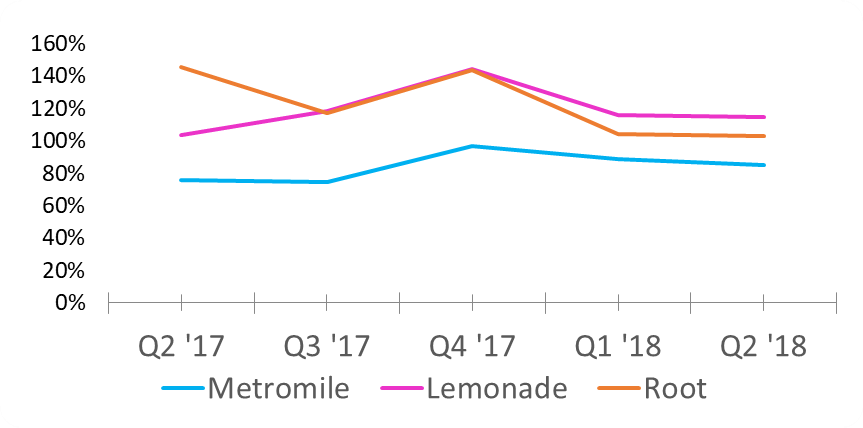

Lemonade Root And Metromile Can David Challenge Goliath With No Sling

Lemonade Weathers A Raging Storm Nyse Lmnd Seeking Alpha

Lemonade Growing Premiums Faster Than Esurance S Homeowners Business Did S P Global Market Intelligence

Lemonade S 2q2020 Results Unpacked The Good And The Bad

Lemonade Ceo P2p Moniker Caused A Lot Of Confusion

A Quarantine Dispatch On Metromile Lemonade And Root S Financials

Lemonade Loss Ratio U S 2020 Statista

Lemonade Root And Metromile Can David Challenge Goliath With No Sling

2020 Insurance Year In Review And The Impact Of Covid 19 Expert Commentary Irmi Com

Insurtechs Still Growing Despite Unsustainable Loss Ratios Industry Execs Reinsurance News

Lemonade A Refreshing Take On Insurance Nyse Lmnd Seeking Alpha

The Lemonade H1 Underwriting Report Almost A Year In Underwriting Renters Insurance Entreprenuership

Lemonade A Refreshing Take On Insurance Nyse Lmnd Seeking Alpha

Insurtech Carrier Growth Slows In 2018

Lemonade S 2q2020 Results Unpacked The Good And The Bad

We Suck Sometimes Lemonade Transparency Lemonade Blog

Lemonade Archives Page 2 Of 20 Insurance Thought Leadership