Every Canadian vehicle owner must have auto insurance in order to operate your vehicle. The following information is designed to help you understand your auto insurance policy and all the various parts that make up your coverage and to help you to purchase the insurance coverage that.

The Major Types Of Car Insurance Explained Youtube

Personal Liability and Property Damage PLPD Insurance.

Car insurance explained canada. In fact its illegal to drive at all without a bare minimum of 200000 in liability auto insurance coverage and its unlikely youll be able to get a policy with anything less than a. This coverage is available on a 24-hour basis anywhere in the world except where prohibited by law or where the coverage is in violation of the terms of the rental contract in the jurisdiction it was formed. Auto insurance is required by law across Canada.

If you have a question about it contact your insurance. Liability is the most basic form of car insurance in Canada. Shopping for vehicle insurance can be confusing for consumers - there are countless options available for automobile owners and just as many prices to match.

Your car insurance covers a variety of damages that occur when an accident happens. Car insurance terms arent always easy to understand. You can decide whether to take Section B coverage.

Some people dont understand the need for auto insurance which can leave them personally exposed and. Understanding Automobile Insurance. Whether youre thinking of submitting a claim trying to understand the process regulations or your policy sometimes the terms used can have you scrambling for a dictionary.

Understanding what each type of coverage can provide and what it costs can give you comfort and save you money. Every care owner must have Section A insurance. Whenever you have to use your car insurance you will have to pay an insurance deductible.

If you are caught driving without insurance your license can be suspended your vehicle can be confiscated and you will face a hefty fine. Auto Insurance Link is one of the leading auto insurance quote engines in Canada and offers auto insurance quotes for more than 25 auto insurers in Canada including car insurance. According to Canadas consumer price index Third Party.

The following are key factors that auto insurers use to determine the price of your auto insurance and what you can do to keep it as low as possible. Driving a vehicle is a basic necessity for many Canadians. Whether youre shopping around for auto insurance your policy is about to expire or youre looking to save money on your current policy it is important to understand how your policy works.

Insurance companies may refer to car insurance as property and casualty insurance. June 22 2020. While the minimum required coverage is 200000 we recommend having at least 2000000.

The following information is designed to help you understand your auto insurance policy and all the various parts that. Everything You Need To Know. The more you know about auto insurance and how the industry works the better off you will be and the more money you can save.

It is compulsory in all territories and provinces. A term mostly used in automobile insurance meaning physical injury as a result of a car collision. Car insurance may protect you from.

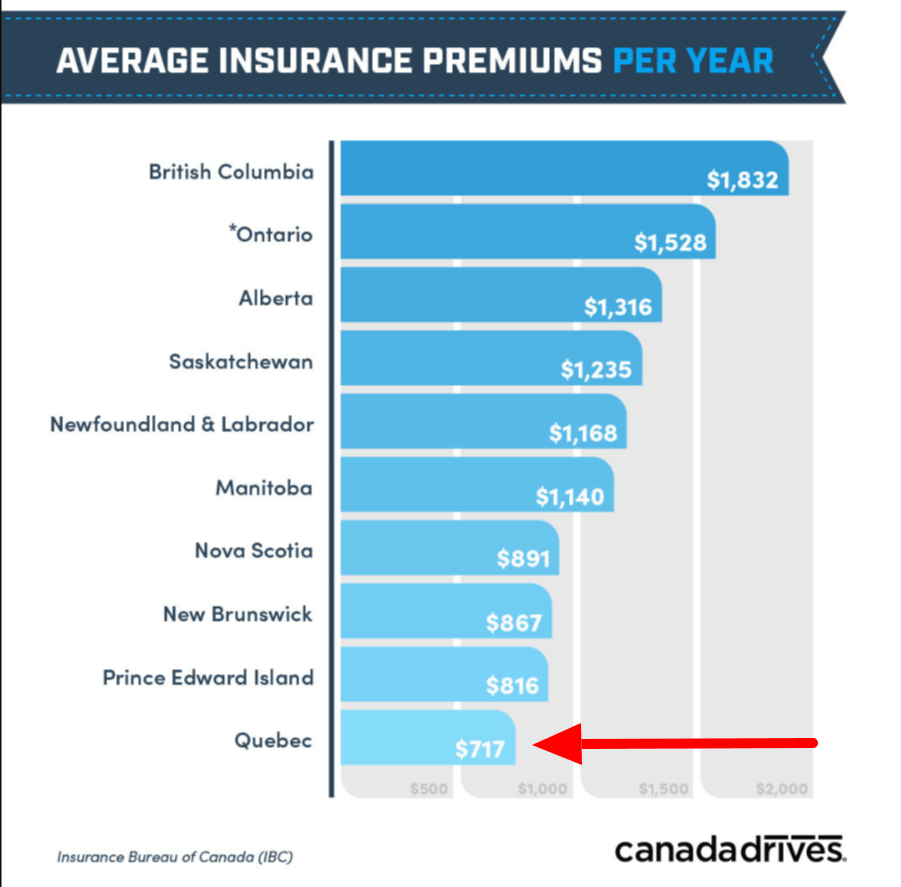

Having to pay to repair your car or other vehicle if its damaged or in an accident. Wwwibcca 9 C. How BC Auto Insurance Prices Compare to Other Provinces.

Section A covers civil liability explained below. Car Insurance Explained. There are two sections to the policy form.

Car insurance and the law in Canada. Auto insurance policy that contains the following. It is a legal safeguard that covers damages caused by your vehicle to.

Thats why weve prepared a helpful glossary of words you may come across in. The average annual car insurance premium in British Columbia is 1680 nearly 14 higher than the next name on the list Ontario 1445. We believe insurance doesnt need to be so complicated.

Whether youre shopping around for auto insurance your policy is about to expire or youre looking to save money on your current policy it is important to understand how your policy works. Liability claims if youre held responsible for an accident causing damage to another persons vehicle or injury to other people. This does not cover your own vehicle.

An endorsement explaining how a particular insurance company deals with a claim which is affected by a local by law. The law is clear. It covers the ownerdriver passengers pedestrians and property involved in a vehicle collision.

If youre very young or quite elderly your risk of being in an auto accident is statisticall. Canadian Auto Insurance Coverage Explained. The law requires individuals who own and drive a vehicle to purchase a standard.

Commonly referred to as third-party liability insurance this type of auto insurance is legally mandatory for drivers in the province of Alberta. Usually car insurance covers personal damages damages that occur from a collision and sometimes they also cover damages that occur from outside forces as well. This article is about auto insurance Canada.

Insurance Bureau of Canada are indicated with an asterisk. If you or someone else using your car is at fault you could be sued if anyone is seriously injured. In short the answer is not well According to a recent report British Colombians are paying the highest premiums in Canada.

To legally drive in Alberta everyone must have liability insurance to cover any at-fault damage or injuries to others. Capital One offers car rental collisionloss damage waiver insurance with all of its Mastercard credit cards in Canada. In Canada auto insurance is compulsory for all drivers.

Section B covers damage to your own car. But once you are behind the wheel the chance of something going wrong is very real. In Quebec all insurance companies offer the same type of private insurance using the Quebec Policy Form.

To know your auto insurance policy.

Why Auto Insurance Is Required By Law In Ontario Aha Insurance

Low Car Insurance Rates With A Bad Driving Record In 2020 Car Insurance Rates Low Car Insurance Car Insurance

What Is The Average Cost Of Car Insurance In Quebec 2021 Kbd

Get Car Insurance Quotes In 2020 Insurance Quotes Auto Insurance Quotes Car Insurance

Drone Car Insurance Claims In 2020 Car Insurance Claim Car Insurance Insurance Claim

Compare Cheap Car Insurance Quotes For Young New Learner Student First Time And Teenage D In 2020 Cheap Car Insurance Cheap Car Insurance Quotes Car Insurance

What Do You Need To Insure A Car Your 5 Point Checklist Aha Insurance

Buy Motor Insurance Online Car Insurance Online Renew Car Insurance Car Insurance

Bất Ngờ Với Mazda 2 Mới Nhất Cả Về Cong Nghệ Va Gia In 2020 Mazda Car Insurance Mazda 2

Rental Car Insurance Explained Nerdwallet Rental Insurance Car Insurance Car Rental

10 Ways To Save Money On Your Car Insurance Tips From An Agent Insuran Buying Tips How To Buy Insura Assurance Voiture Assurance Auto Voiture Jeune Conducteur

Business Insurance Explained By Risk Management Advisor Business Insurance Risk Management Insurance

Blogspot Image Undefined Getting Car Insurance Affordable Car Insurance Car Insurance

If Life Insurance Plans Were Cars How To Look At Various Types Of Life Insurance In Canada How To Plan Insurance Life Insurance

What Is Health Insurance Definition What Is Health Health Insurance Health

How Car Insurance Works In Canada Td Insurance

Types Of Auto Insurance Coverage

96 Reference Of Auto Vehicle Insurance Definition Car Insurance Insurance Definitions