Michigans auto insurance reform implements other protections to help reduce costs such as the elimination of non-driving factors in rates a fraud investigation unit MCCA transparency prior. Auto coverage protection and low cost.

Why Is Michigan Car Insurance So Expensive

Progressive offers a variety of discounts giving you plenty of ways to save on car insurance.

Progressive auto insurance michigan reform. Michigans new no-fault law means drivers have more options for personal injury protection coverage also known as PIP benefits PIP covers medical bills from injuries sustained in an auto accident as well as rehabilitation costs lost wages attendant care services tending to an injured person and other expenses. Michigan passed auto insurance reform laws to lower policy costs for its citizens in July 2020 as reported by Bankrate. There has been repeated mention of the expense of automobile insurance and the need for reform.

The same holds true today under phone 1-800. Property Damage 10000 per accident in another state Personal Injury Protection. The Progressive Insurance earnings report showed a substantial increase in its combined ratio.

Progressive Marathon Insurance Company is no stranger for regular readers of this auto law blog. If you took advantage of this option youll need to take additional action to renew it. The new law which goes into effect on July 1 2020 will allow motorists to completely opt out of buying personal injury protection PIP as part of their auto insurance if their health insurance covers auto injuries.

This reform made a. As part of Michigan Auto Insurance Reform drivers can choose from up to four levels of Personal Injury Protection Allowable Expenses PIP AE the coverage that pays for medical coverage if you are injured in an auto accident. Bodily Injury 50000 per person.

Cheapest auto insurance company in Michigan. Youll have the option of choosing from different levels of personal injury protection coverage. Michigan Car Insurance Changes.

CMDA Law June 24 2020. For the past year the headlines have been filled with news about changes to the Michigan auto insurance law. The legislation was intended to create a better no-fault.

1994 Progressive surpassed written premiums of 2 Billion dollars. The new Michigan no-fault auto insurance law means that residents are no longer required to buy unlimited personal injury protection or PIP with their auto insurance. In response to Michigans consistently high auto insurance rates law insurance reform was passed in July of 2020.

1518 for six months or 315. An important change involves Order-of-Priority OOP which determines the insurer or entity primarily responsible for payment of personal injury protection PIP benefits resulting from a motor vehicle accident in Michigan or another state. Michigan Auto Insurance Reform.

Michigan auto insurance laws. Bodily Injury 100000 per accident. Drivers can select from the available coverage options unlimited 500k 250k and eligible Medicaid enrollees may.

Gretchen Whitmer signed the auto insurance overhaul into law last May with the goal of lowering Michigans auto insurance rates by many measures the nations highest. You must have minimum coverage to drive as follows under the new laws. As of July 2020 the state of Michigan has changed the required amounts of PIP coverage.

By bundling your home and auto insurance in Michigan you can better protect your valuable assets and save money at the same time. Last fall Governor Whitmer signed bipartisan no-fault auto legislation known as PIP reform or No Fault Reform which will go into effect on July 1 2020. Under Michigans revised auto insurance laws drivers with qualifying health insurance can opt out of unlimited Personal Injury Protection PIP in exchange for lower levels of coverage.

The most significant amendments to the Michigan No-Fault law take effect on July 1 2020. See whats changing for Michigan drivers regarding personal injury protection PIP benefits. Michigan auto insurance coverage reform is right here.

Auto insurance coverage insurance policies are regulated and insurance coverage corporations should apply the ranking plan filed with the state. 1994 1-800-AUTO-PRO rate comparison shopping service is introduced where customers can get competitive quotes from up to three competitors plus a Progressive Quote in one call. What you choose is important because PIP covers more than medical expenses.

Michigan auto insurance reform has brought about sweeping fundamental and unprecedented changes to Michigans No-Fault law that affect every driver and car accident victim in this state. She recently received a written quote from her insurance company Progressive for a new rate under the new system. From March 2020 to March 2021 the insurers combined ratio in that month rose by 771 percent to 907 percent up a substantial 136 percent.

The goal of this legislation is to reduce premiums for Michigan drivers while maintaining the highest coverage options in the country. Michigans new auto insurance reform law will take effect on July 2 2020 bringing a number of changes to the current no-fault insurance system. In Michigan the state minimum coverage requirements are as follows.

Its also no surprise that this company was the most-complained-about auto insurance company in Michigan in 2018 according to the most current consumer complaint information compiled by the Department of Insurance and Financial Services DIFS. Michigans new no-fault law means drivers have more options for personal injury protection coverage also known as PIP benefits PIP covers medical bills from injuries sustained in an auto accident as well as rehabilitation. 1992 Progressive is the largest seller of auto insurance through independent agents.

What is Michigans car insurance reform. Michigan Auto Insurance Reform 2020. Here are just a few of the discounts available in Michigan.

The changes include PIP choice opt-outs attendant care limits a fee schedule and. Most drivers will be. On July 2 2020 a new law let Michigan drivers choose the Personal Injury Protection PIP option that best met their unique needs and budget.

The new law makes major changes and significantly it eliminates the states requirement that all drivers buy unlimited lifetime medical coverage for car accident injuries. But that could change following Michigans passage of sweeping car insurance reform which went into effect July 2 2020. This means that motorists can select the amount of medical coverage they want when purchasing their auto insurance.

What is Michigans car insurance reform.

Health Care Providers Patients Start To Feel Effects Of Auto Insurance Reform Wwmt

Navigating Auto Insurance Reform Part 6 Motorcycles Mcca Fees More Saginaw Bay Underwriters

What To Know About Changes To Michigan S Car Insurance Law Mibluesperspectives

See What S Changing For Michigan Drivers Regarding Personal Injury Protection Pip Benefits

Michigan Auto Insurance Reform Valuepenguin

Best Cheap Car Insurance In Michigan 2021 Forbes Advisor

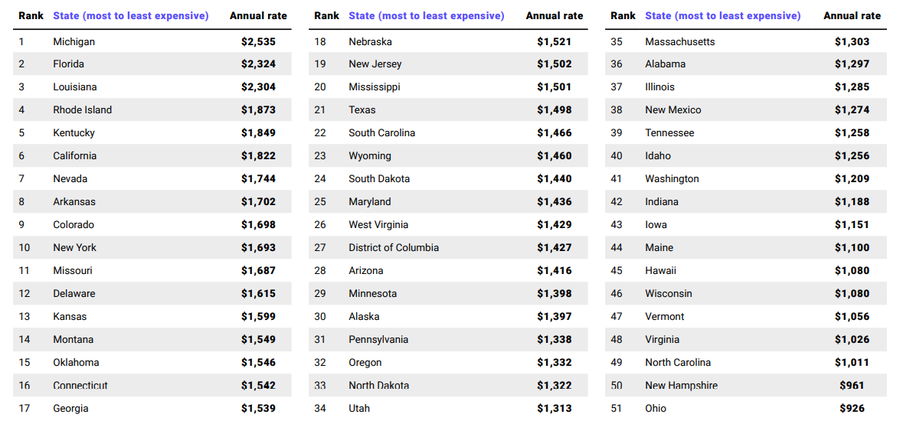

Michigan Car Insurance Rates Decline By 18 But Are Still The Highest In The Country Wdet

Michigan S Catastrophic Claims Vehicle Fee Will Be The Lowest In 19 Years Forbes Advisor

How Delay In Taking Term Life Insurance Can Cost You Heavily Term Life Term Life Insurance Life Insurance

The Best And Cheapest Car Insurance Rates In Michigan Valuepenguin

Just Picked Up The Chris Brown S Punch Out Video Game And The Only Two Characters He Goes Up Against Are A Woman And A Gay Man By Lee Mays Pinterest

The Best And Cheapest Car Insurance Rates In Michigan Valuepenguin

How To Make An Insurance Claim Like A Pro Insuranceclaim Infographic Insurance Claim Insurance Infographic Marketing

No Fault Archives Saginaw Bay Underwriters

Michigan Auto Insurance Reform 2021 Future Insurance Agency

Michigan Car Insurance Laws Everything You Need To Know

Michigan Auto Insurance Fee To Drop 55 Under New No Fault Law Michigan Auto Law Jdsupra

Best Car Insurance In Michigan Everything You Need To Know