North Carolina Department of Insurance 325 N. The court system can double any fine for operators of commercial motor vehicles that violate motor vehicle laws in which points are assessed.

Fmg Insurance Quote Life Insurance Quotes Home Insurance Quotes Insurance Quotes

North Carolina has some very strict limits for drivers with NC auto insurance.

North carolina car insurance rules. 30 000 for bodily injury for one person and at least 25 000 for property damage caused by an accident involving your car. Contact NCDOI Careers at. Proof of coverage must also be carried while you are driving and must be shown at the request of law enforcement officials.

In North Carolina liability coverage is required along with uninsured motorist coverage. The state required coverage however does not pay for the theft of your car or its repair damages. But North Carolina has one of the countrys strictest contributory negligence laws.

Minimum car insurance in North Carolina is fairly straightforward. Some states require vehicle owners to have no-fault auto insurance coverage in which insurers must pay for damages after a car accident regardless of fault. It also covers up to 25000 for damage to another persons property.

Salisbury Street Raleigh NC 27603-5926. Commercial drivers are DWI in North Carolina if their BAC reads 004 or higher. Some of the new passages take effect April 1.

North Carolina like most states requires vehicle owners to maintain certain minimum amounts of coverage in order to obtain license plates and operate a vehicle legally on the states roads and highways. Underage drivers are DWI if any detectable or suspected intoxicants are found in their system. North Carolina requires a minimum liability insurance policy of at least 30000 bodily injury per person 60000 bodily injury per accident and.

North Carolina law allows insurance companies to use fault for a car accident to deny payment of claims. North Carolina drivers must pay 200 the third time they are caught without insurance. Albemarle Building 325 N.

If youre buying car insurance in North Carolina the law requires you to have the following minimum amounts of liability car insurance coverage. North Carolina drivers must pay 100 the first time they are caught without insurance. Learn the requirements for titling and registering your vehicle in North Carolina.

North Carolinas strict rules on determining fault in car accidents are known as pure contributory negligence laws. It is your responsibility to stay current about the legal requirements in North Carolina. Laws regarding driving and car insurance can change frequently.

North Carolina Auto Insurance Requirements. The following laws have recently been enacted in North Carolina and may affect your insurance coverage decisions. In the event of a covered accident your limits for bodily injury are 30000 per person with a total maximum of 60000 per incident.

Car insurance is certain to play a part in any claim thats made after a car accident. The minimum amount of North Carolina auto insurance coverage is 300006000025000. Yes car insurance is legally required in North Carolina.

North Carolina drivers must pay 150 the second time they are caught without insurance. The state has since approved multiple changes to North Carolina Administrative Code Title 11 which governs insurance in the state. The driver must maintain proof of continuous insurance throughout the registration period.

The limits for a personal vehicle as opposed to a commercial vehicle are. It is one of the few states with mandatory minimum requirements for a policy. North Carolina Department of Insurance.

Drivers in North Carolina must carry a certain amount of car insurance to be legal. Drivers must carry at least 306025 coverage which translates to 30000 in bodily injury liability coverage per person 60000 in. Before any North Carolina resident can obtain a drivers license or lawfully operate a vehicle the vehicle must be properly insured.

North Carolina requires that you have continuous car insurance coverage meaning that it cannot lapse. If you have a lapse in car insurance coverage in North Carolina your insurance company is required by law to notify the Division of Motor Vehicles. There is a ban on texting for all North Carolina.

This coverage is required in order to protect you and others on the roads. North Carolina Car Insurance Laws In the state of North Carolina it is illegal to drive any motor vehicle without proof of insurance or financial responsibility. 30000 for bodily injury liability per person injured in an accident you cause.

NC Department of Insurance 1201 Mail Service Center Raleigh NC 27699-1201. This means that the victim has to be 100 percent free of fault for the accident in order to receive compensation. If the DMV gets notification of a lapse on a certain date they will send a request that an insurance agent confirm that you were sufficiently covered on that date by submitting an FS-1 as proof of insurance.

If a driver has been previously convicted of a DWI after July 1 2001 they are considered DWI if their BAC is 004 or higher. If you have questions the Consumer Services Division of the Department of Insurance is here to help. 30000 of coverage for injuries or death involving one person in a single accident 60000 of coverage for injuries or deaths involving two or more people in a single accident and 25000 of property damage coverage.

Minimum insurance requirements for North Carolina. Upon receiving this information the Division of Motor Vehicles is required to send a Form FS 5-7 Notice to you in. Policies are generally issued for six-month or one-year time frames and can be renewable.

The North Carolina Car Insurance Requirements are. There are now minimum limits of insurance requirements for commercial motor vehicles licensed in North Carolina whether interstate or intrastate private or for hire in the amount of 750000.

The Hidden Agenda Of Cheap Insurance For Teens Cheap Insurance For Teens Car Insurance Affordable Car Insurance Cheapest Insurance

How Much Does Insurance Pay For A Totaled Car In North Carolina Protective Agency

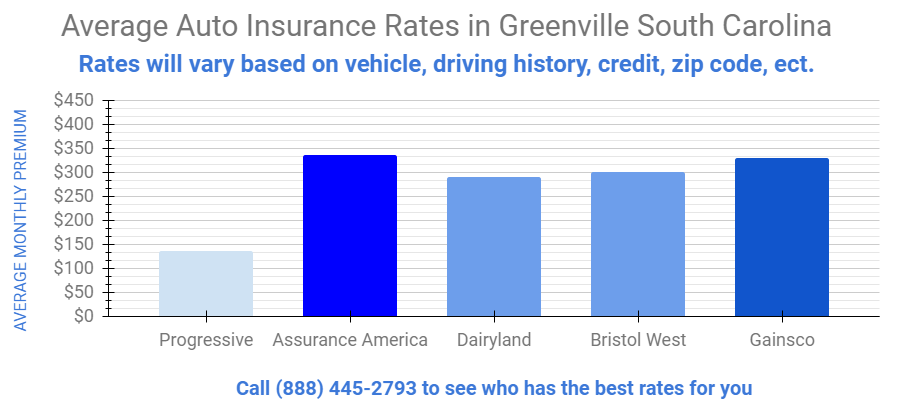

Cheapest Car Insurance In South Carolina For 2021

Auto And Vehicle Insurance Nc Doi

Affordable Car And Home Greenville South Carolina Insurance For 2021 A Plus Insurance

The Best Cheap Car Insurance For 2021 Money

How Much Does Car Insurance Cost On Average The Zebra

How Much Does Car Insurance Cost On Average The Zebra

The Cheapest Car Insurance Rates In North Carolina Valuepenguin

Best Cheap Car Insurance In North Carolina 2021 Forbes Advisor

Consequences Of Not Having Auto Insurance In North Carolina Browning Long Pllc

Who Has The Best Cheap Car Insurance In North Carolina For 2021 Moneygeek Com

The Cheapest Car Insurance Rates In North Carolina Valuepenguin

Cheapest Car Insurance Companies November 2021 The Zebra

Http Autoinsuranceape Com Cheap Auto Insurance Infographic 6 Tips To Save On Auto Insurance Auto Insurance Quotes Car Insurance Cheap Car Insurance Quotes

Car Insurance Costs For 21 Year Old Males And Females Valuepenguin

Car Insurance Costs For 18 Year Old Males And Females

How Much Is Car Insurance Average Car Insurance Costs 2021 Policygenius

Best Cheap Car Insurance In North Carolina 2021 Forbes Advisor