File a police report. If the insurance company is unable to obtain a commitment to make payments some companies will then turn the uninsured driver over to a.

Geico Auto Liability Insurance Coverage Di 2021

2 What happens if the other person doesnt have insurance.

Do insurance companies go after uninsured drivers. There are few things you need to keep in. This will probably bankrupt him or her but the MIB will not mind. Filing uninsured motorist claims is generally the most successful way to get your expenses covered after an accident with an uninsured driver.

That however is changing as profits in the insurance industry are under pressure mostly due to the fact that only one-third of South Africans have vehicle insurance which means that they are picking up the tab for the rest of. Follow these steps before you leave the scene of the car accident. There will be pretrial investigation disclosure of your medical records and depositions of witnesses.

However insurance premiums may still rise slightly after an uninsured motorist claim. While insurance companies have always had the ability to go after uninsured drivers to recover the costs of damages the litigation has not always been worth the cost. 52 rows Will Insurance Companies Go After Uninsured Drivers.

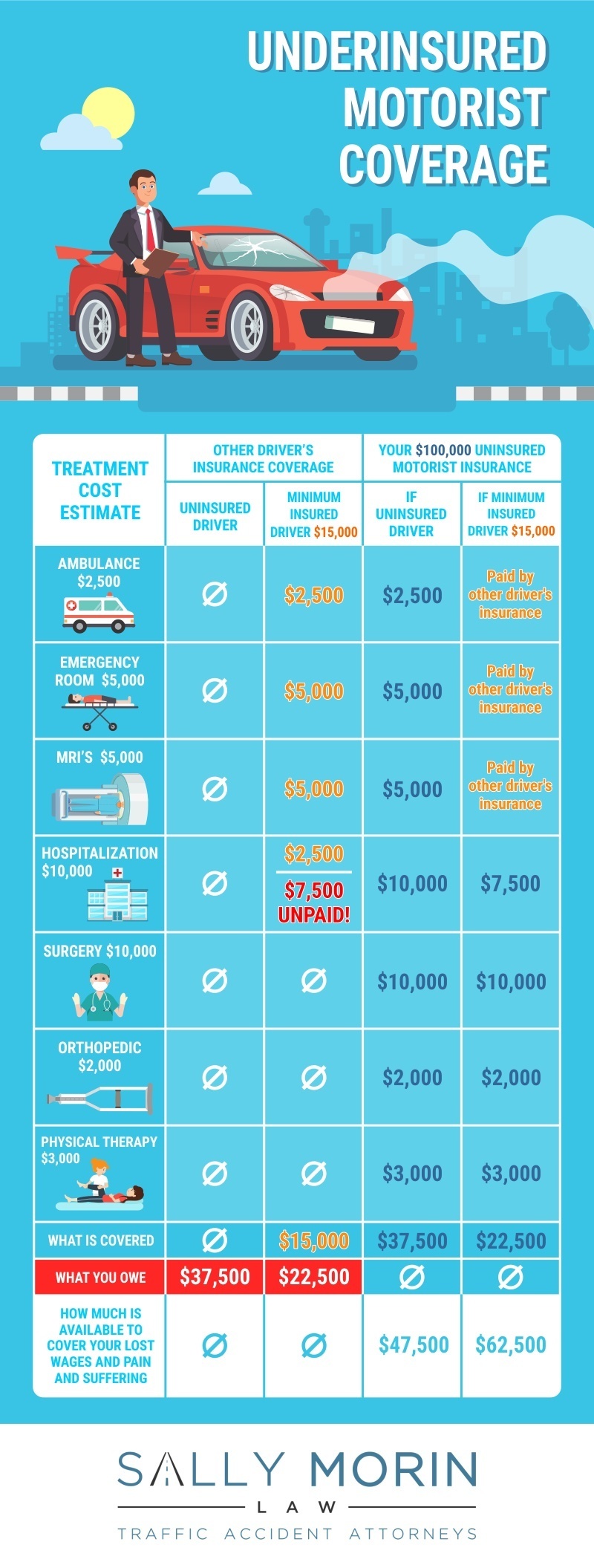

The insurance company will not legally go after an uninsured at-fault driver if you do not carry collisioncomprehensive or uninsured motorist coverage. If they choose to subrogate then your insurance company will refund your deductible from whatever they collect from the other driver. When an uninsured driver causes a car accident it leaves you to bear the financial burden alone.

After a claim or when you are acquiring your coverage insurance companies would input this information into a mathematical formula and charge premiums depending on the risk factors. A hit and run driver also count as uninsured as it relates to bodily injury UMBI though not normally for property damage UMPD. Call the police and report your accident.

Those who are insured may not have enough insurance coverage to pay for even moderately severe injuries. If youre in an accident where you are not. But your insurance company will probably go after the other driver themselves.

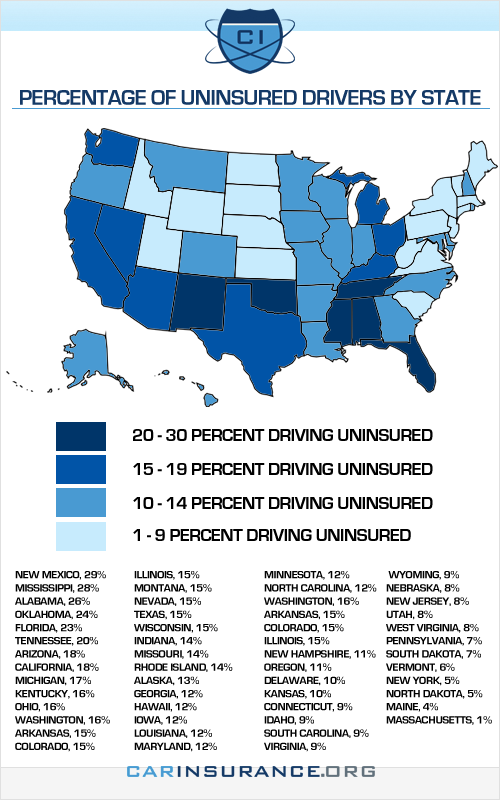

It becomes up to you to pay for the damage they caused. Thousands of drivers are on our roads each day without insurance coverage. As a result more than 13 percent of Illinois drivers are uninsured.

Although drivers must show proof of insurance in order to register their car they can cancel the insurance shortly after that. Indeed insurance companies are legally allowed to deny claims for any number of. It is good publicity about the value of being insured.

This is called subrogation. Whether the driver who hit you had insurance or not its important to take steps to protect your health and your rights at the scene of the accident. Suing an underinsured motorist is not easy.

Call the police and file an official report. When an uninsured driver is at fault in a car accident the insureds insurance companies are usually responsible for the damages. You can sue the uninsured driver.

If you dont have uninsured motorist coverage on your own insurance policy you cannot make a claim or recover damages against an uninsured driver. Whats Uninsured Motorist Coverage UM. Suing an uninsured driver for damages will result in a judgment against that person.

You must sue the at-fault driver even though he or she does not have insurance. Yes you can sue the other driver. Depending on your state uninsured or underinsured motorist coverage may be required.

In general an uninsured or underinsured driver claim progresses in the same way as a regular car insurance claim except that the claim is against your own insurance company. However here is the catch when having to sue your own insurance company. After any car accident or vehicle collision drivers look to their insurance and that of the other driver for property damages and personal injury.

They will still owe you the determined sum. Youll call your insurance company and file a. Its important to keep in mind that just because you can file a claim with your insurance company after being involved in an accident caused by an uninsured driver that doesnt mean your insurance company has to pay.

How to make a claim after being hit by an uninsured driver. In fact some states forbid insurance companies from raising insurance premiums after an uninsured motorist claim underinsured motorist claim or comprehensive coverage claim. Steps to Take After Youre Hit by an Uninsured Driver.

If you are in an accident with a driver who is uninsured or underinsured you may have to rely on your car insurance to pay for your medical bills as well as your vehicles damage provided you are insured. The car insurance company turns uninsured motorist claims over to their subrogation department. Youre given a report to fill out that validates the authenticity of your accident.

Now this in a lot of states is not mandatory but you can pay an additional premium and have it. Although some of these factors might raise your insurance rate after. If you are in a car accident with an insured driver whose policy does not cover the costs of the damages then underinsured motorist coverage will protect you in.

In Georgia that lawsuit cannot be filed directly against the insurance company. The MIB is a requirement of doing financial insurance business in Europe. Underinsured Motorist Coverage on the other hand its coverage that when youre in an accident with an at-fault driver whose liability limits are too low to cover the damages or your medical expenses then you can go after your own company if 000200 you carry the Underinsured Motorist.

Making your insurance claim is quickly done with these simple steps. If you drive without car insurance you face a fixed penalty notice of 300 fine and up to six penalty points on your licence. Uninsured coverage may also come into play if the other drivers insurance company denies their claim or is not financially able to pay it.

Your car is likely to be seized too. THEN they will go after the uninsured driver and seek to get all those damages as well as legal fees from him or her. The cost of compensating the victims of uninsured drivers is added on to your car insurance premiums making them more expensive than they should be.

Several attempts are made by this department to make payment arrangements with the uninsured driver to pay for the damages over time. Suing an Uninsured Driver for Damages After a Car Accident. If youve included uninsured or underinsured motorist coverage your insurance will pay the claim after a collision with an uninsured driver.

However most uninsured drivers dont have enough assets to pay for the damages caused by a traffic accident. Being in a car accident is a stressful and frustrating experience no matter what the circumstances but it can be especially exasperating if youre in an accident caused by an uninsured or underinsured motorist.

Why Buy Uninsured Motorist Coverage

Car Insurance Quotes Examples Quotesgram

Uninsured Motorist Coverage In Michigan What You Need To Know

Auto Insurance Facts And Figures Infographic Car Insurance Car Insurance Facts Car Insurance Rates

Chicago Uninsured Motorist Um Lawyer Rosenfeld Injury Lawyers

Different Coverages For Auto Insurance In 2021

Why Buy Uninsured Motorist Coverage

What Type Of Motor Vehicle Insurance Do I Need Accident Insurance Car Insurance Insurance

Online Car Insurance Car Insurance Banner Car Insurance Cheap Car Insurance Online Cars

Home And Contents Insurance Application Form Compare Quotes Insurance Quotes Content Insurance

Protection From Uninsured Drivers Td Insurance

What To Do If An Uninsured Driver Hits You Direct Auto

How Much Uninsured Motorist Insurance Should I Get

How The States Rank On Uninsured Drivers Carinsurance Org

How Much Does Insurance Go Up After An Accident Car Insurance Car Insurance Rates Cheap Car Insurance

Investmentstrategies Investing Investment Cars Insurance Carinsurance Finance Business Car Insurance Cheap Car Insurance Quotes Car Insurance Rates