Because you met the deductible your health insurance plan begins to cover the costs. Your insurer will pay 2500 to repair your car and youll be responsible for the remaining 500.

Read Is A Disappearing Deductible Worth The Cost And What Does It Mean Carsurer Com

You will pay 500 out of pocket in this scenario and your insurer will pay the remaining 4500 to cover the 5000 of damage.

$500 deductible car insurance meaning. Think of it as the part of a loss you have chosen to self-insure. To ensure your auto insurance covers the repairs you will have to file a collision claim. Best car insurance with a 500 deductible.

For example say you opted for collision coverage with no deductible. If you had a 500 deductible youd pay 500 and they would pay 500. The remaining 5000 is covered by insurance but you may still be required to pay a percentage of the costs depending on if your plan has copays or coinsurance.

Lets say that you have a 500 deductible. Most leasefinance agreements mandate a deductible of 500 or less so that takes the decision out of your hands. You get into an accident file a claim and find out there is 5000 worth of damage.

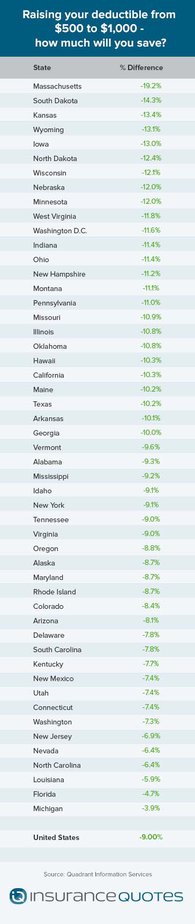

A low deductible of 500 means your insurance company is covering you for 4500. Going to a 1000 deductible may save you even more. A deductible is the amount of money you the named insured on the policy pays out of pocket for the cost of damages before the insurance company pays.

You pay the deductible if. You have a 500 deductible and 3000 in damage from a covered accident. If your deductible is 1500 the insurance will not pay to repair the damage.

You will be responsible for paying the initial 500 and the insurance company will then pay the remaining 3500. You chose a 500 deductible when you purchased your auto policy. The Pros and Cons of a High Car Insurance Deductible.

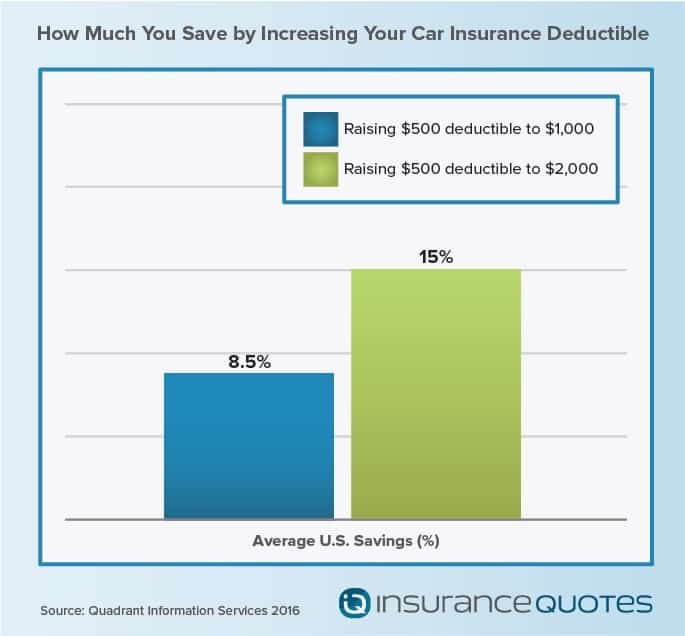

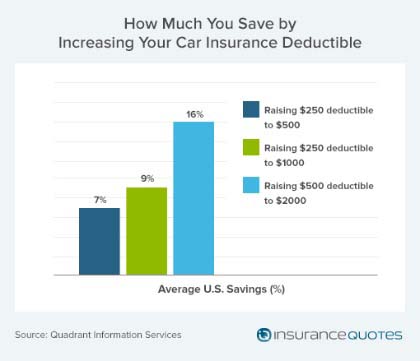

According to the Insurance Information Institute increasing your deductible from 200 to 500 can make you eligible for a 15- to 30-percent premium discount while raising the deductible to 1000 can save you up to 40 percent. A higher deductible of 1000 means your company would then be covering you for only 4000. You pay 500 out of pocket to the provider.

A 500 deductible means youll pay 500 out of pocket after an accident and your insurer will pay for the rest of the damages up to your policy limits. If youre driving a beater car you may even drop your collision and comprehensive coverage entirely. Comprehensive and collision are the two most common car insurance coverages that include deductibles.

Typically you can choose a deductible of 250. A car insurance deductible is the amount of money youll pay out of pocket for an accident before your insurance company pays the rest. Say you get in a car accident and your car needs 8000 worth of repairs - if your deductible is 500 youll need to pay that 500 before the insurance company pays the remaining 7500 in.

If you have a covered claim for 1500 in repairs your insurer would reimburse you the full 1500. Some car insurance companies allow drivers to pay as little as 200 for their deductible. You can raise or lower a 500 deductible car insurance policy depending on your financial needs.

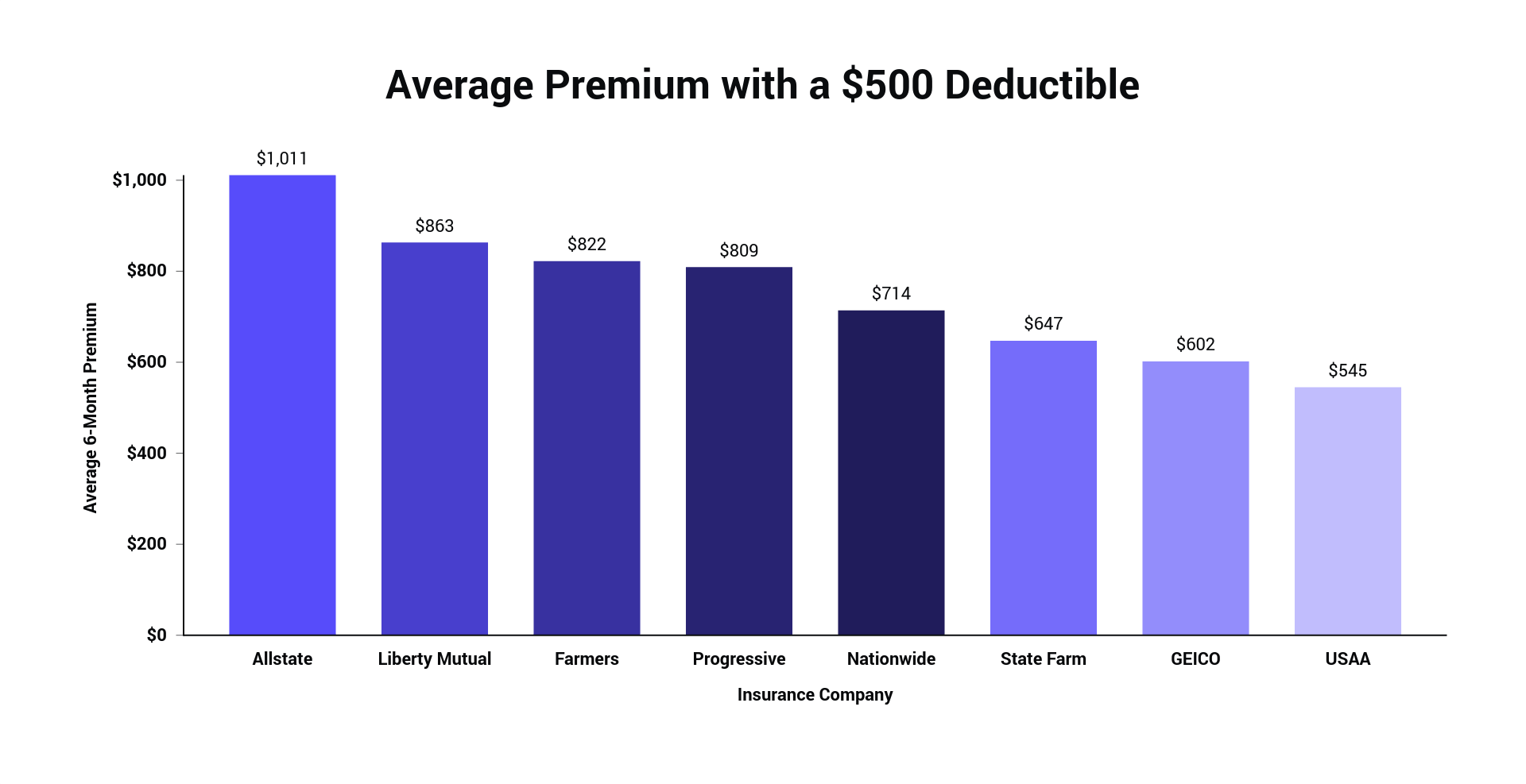

You back up your car and collide with a fire hydrant that results in 3000 worth of repair costs. No coverage no deductible. The average six-month premium for car insurance with a 500 deductible is a little over 900 or about 150 per month.

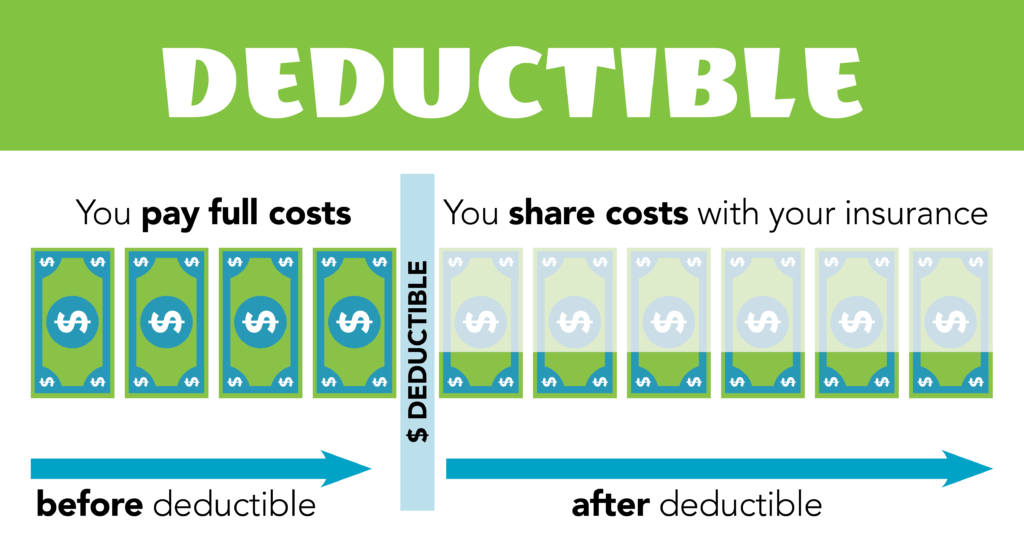

A deductible is the amount youre responsible for paying for health care before your insurance takes over. If you opt for a 500 deductible this is the sum youll have to pay. A 500 deductible insurance policy means that you must pay 500 toward car repairs before your car insurance coverage pays the rest of your car damage costs.

This deductible amount is a common choice for drivers. Deductibles are the cost you will pay out-of-pocket during an insurance claim. The minimum deductible for auto insurance tends to be slightly less than it is for home insurance.

500 is considered a standard car insurance deductible. Since a lower deductible equates to more coverage youll have to pay more in your monthly premiums to balance out this increased coverage. For example lets say that your deductible is 500 and youre involved in an auto accident that causes 4000 dollars in damage to your vehicle.

A deductible is the amount you pay before your insurance kicks in. For home and renters insurance insurance companies commonly set a. Well explore what deductibles are how they impact your premium and your insurance policy and which insurance companies offer the cheapest car insurance quotes with a deductible of 500.

Say you backed your car into one of the light posts in the mall parking lot and caused 1000 worth of damage to your car. This means if you have a claim approved for 10000 and your deductible is 500 youll receive a payout of 9500. For example if youre in an accident that causes 3000 worth of damage to your car and your deductible is 500 you will only have to pay 500 toward the repair.

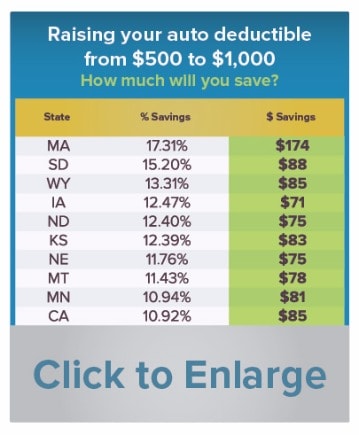

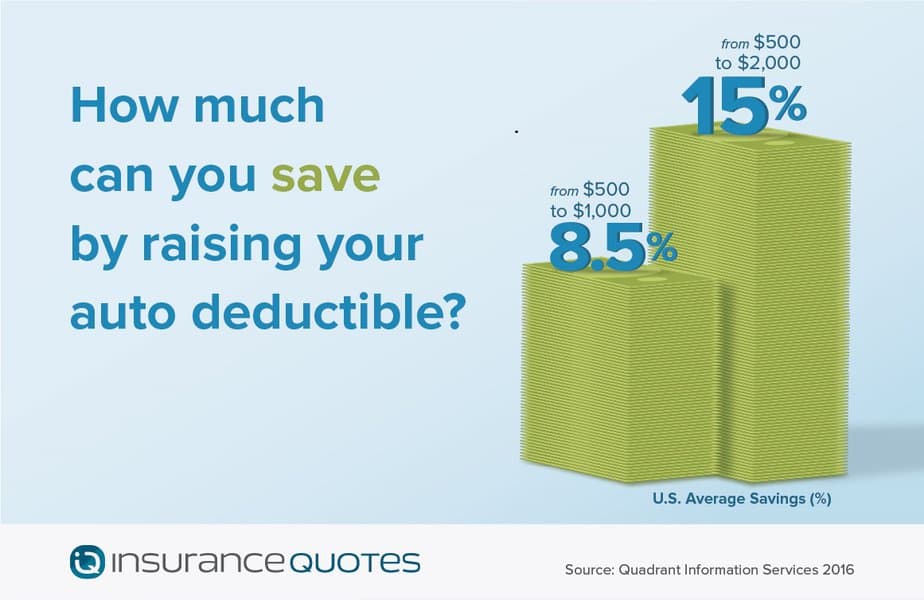

Increasing the dollar deductible from 200 to 500 on your auto insurance can reduce collision and comprehensive coverage premium costs. Raising the deductible to more than 1000 can save on the cost of the policy. How much can you save by raising your auto insurance deductible.

If your deductible says 5001500 that means each individual on the plan has a maximum 500 deductible. For example if you file a claim for 1500 and you have a 500 deductible you will have to pay the 500 deductible before your insurer will cover the. A car insurance deductible is the amount of money you have to pay toward repairs before your insurance covers the rest.

If your car repairs are less than your 500 deductible you. The portions of a policy that carry a deductible are two optional coverages comprehensive and collision that cover physical damages. A 500 deductible is a fairly common choice which means you should be able to find quotes from numerous providers with this deductible amount.

The second number refers to the maximum deductible for all. What factors should I consider when choosing a deductible. Most homeowners and renters insurers offer a minimum 500 or 1000 deductible.

This is what happens next. Having zero-deductible car insurance means you selected coverage options that dont require you to pay any amount up front toward a covered claim.

Deductibles Explained Etrustedadvisor

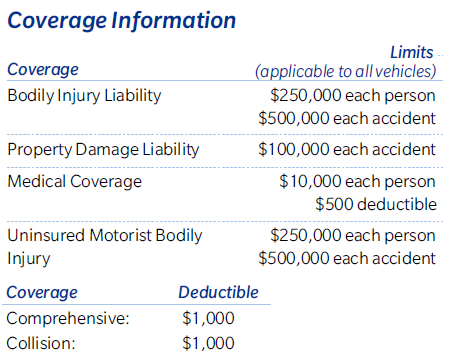

Auto Insurance Types And Purpose Of Coverage

Raise Deductible To Save On Auto Insurance Insurancequotes

How Much Can You Save By Raising Your Auto Insurance Deductible

How Much Can You Save By Raising Your Auto Insurance Deductible

Major Mistake To Avoid While Car Insurance Deductible

Raise Deductible To Save On Auto Insurance Insurancequotes

How Do Deductibles Affect Car Insurance Premiums Valuepenguin

Understanding Auto Insurance Deductibles When They Apply How They Affect Rates Insurancehotline Com

How To Choose Your Car Insurance Deductible Kelley Blue Book

What Is An Auto Insurance Deductible How Does It Work We Explain It

Deductibles Explained Etrustedadvisor

Best Car Insurance With A 500 Deductible The Zebra

Raise Deductible To Save On Auto Insurance Insurancequotes

What Is An Insurance Deductible Napkin Finance

How Does Your Car Insurance Deductible Work Insurancequotes

Should I Have A 500 Or 1000 Auto Insurance Deductible Youtube

Auto Insurance Deductible When You Are Not At Fault Apex Auto Center Inc

How Does Your Car Insurance Deductible Work Insurancequotes